See more about the Banking platform

Cloud for Mortgage

Transform and modernize the mortgage lifecycle

The mortgage industry remains a cornerstone of the US economy. However, current market conditions and growing digital expectations of the consumers mean high cost pressures for mortgage bankers. They are now urged to rethink what technology is needed to secure profitability.

Cloud for Mortgage addresses the challenges of the US mortgage market by providing a new, fully integrated toolkit for mortgage servicing in a highly configurable cloud package.

What is Cloud for Mortgage

End to end mortgage servicing

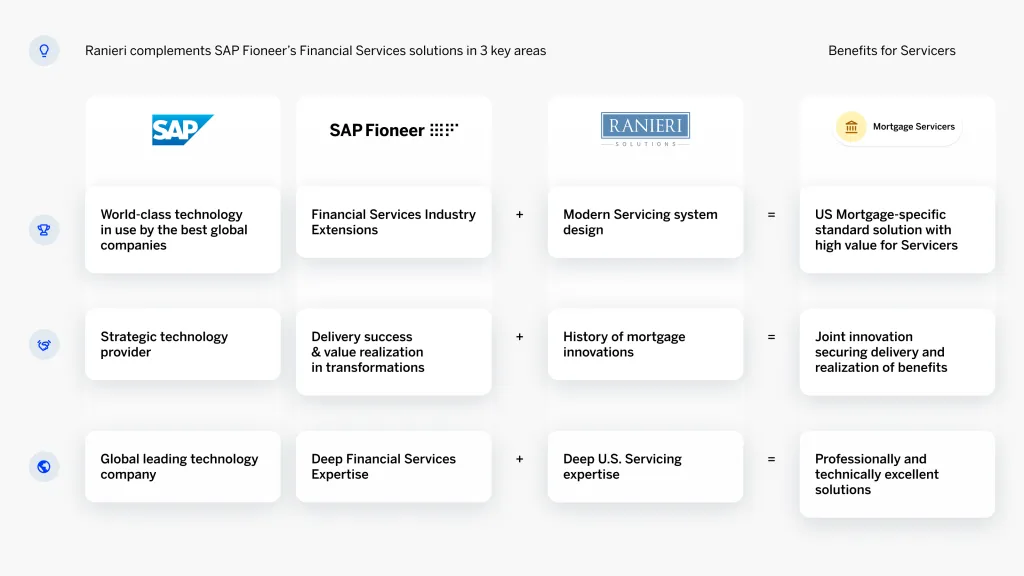

Cloud for Mortgage is the first new full end to end mortgage servicing system to come to market in fifty plus years. Designed by Raniere Solutions, backed by proven SAP world class technology, built by SAP Fioneer, and hosted on Microsoft Azure Cloud, Cloud for Mortgage provides a highly configurable servicing system all in one integrated platform.

How it works

Cloud for Mortgage offers an intuitive, user-friendly platform that centralizes all loan servicing information. It features real-time portfolio queries, REST API communication, and document access within the system. The platform includes workflow tools for task management and secure access for authorized users, enhancing efficiency and reducing costs without the need for additional systems or custom code.

What are the benefits?

Cloud for Mortgage will transform the fractured mortgage technology landscape into one holistic best-in-breed platform, reducing operational and technical overhead. Leveraging the powerful SAP S/4HANA in-memory database and its Business Technology Platform, mortgage firms will have an integrated view of their data, powerful analytics, machine learning and AI, and provide customers with a smooth user experience.

Comprehensive mortgage management

Our flexible software adapts to your needs, offering end-to-end functionality through a single system of record and consistent data model. Configure any stakeholder experience from loan boarding through payoff all using a single unified customer profile.

Pre-configured and extendable

Cloud for Mortgage offers out-of-the-box standard processes for rapid deployment, based on the latest best practices. Leverage an intuitive user interface, automated event-triggered workflows and seamless connectivity to third parties. Expand your services with a suite of pre-configured apps in just a few minutes.

SaaS delivery

Simplify your IT processes with our streamlined SaaS delivery model with reduced costs from what servicers are currently paying. Our secure, compliant platform can be deployed at any scale. Clients only pay for services they use and don’t have to pay additional fees to utilize their own data.

Key benefits

Automation and data

Empower your team to automate complex business processes faster and improve data quality, benefiting from world-class SAP technology used by 85% of the world’s largest enterprises.

Servicing operations

Unlock operational efficiency and flexibly to scale your servicing operations with our streamlined end-to-end mortgage servicing solution. C4M (cloud-based ERP system) drives upwards of 97% automation/straight through processing in other geographies, enabling U.S. servicers now to achieve optimal results.

Borrower retention

Improve customer experiences with intuitive and digital experiences, making every interaction count. C4M helps to guide homeowners and servicers through every step of the way via our real-time 360° customer view for service agents.

Portfolio risk management

Enable an integrated view of your portfolio risk through better loan controls, with improved ad-hoc, self-service reporting without IT involvement. Leverage a common data model within your organization.

Compliance risk mitigation

Manage compliance risks with transparent audit trails using our real-time dashboard on an easy to configure, intuitive platform. Adapt to regulatory changes with rapid implementation.

Why SAP Fioneer

Cloud for Mortgage is built on world-class proven SAP technology, currently used by 97% of Forbes top 2000 banks for innovation. We provide a reliable, scalable and compliant foundation built on vast experience and international best practices.

We are on a mission to modernize the US mortgage industry by leveraging our ERP experience combined with ecosystem partners specialized on US mortgage. Leverage full commercial flexibility through modern pay-per-use pricing, without hidden fees or minimums.

800+

customers trust SAP Fioneer’s lending solutions

40+

countries deploy our lending solutions

1 bn

transactions processed by SAP Fioneer systems a day

70bn

USD assets managed on our platform

Explore more

Brochure

Cloud for Mortgage: Next-generation mortgage servicing

Find out more about Cloud for Mortgage and how it could help you to run your Servicing business better

PRESS

SAP Fioneer to expand its mortgage solution

to the US Market

Learn how SAP Fioneer is looking to revolutionize the US mortgage market.

BLOG

Using the power or ERPs for loan lifecycle management

We take learnings from building ERP processes and apply them to the mortgage industry.

RELATED PRODUCT

Cloud for Banking

Cloud for Banking is a comprehensive SaaS-based platform with a wide-array of functionalities and robust scale.

RELATED PRODUCT

ESG KPI Engine

ESG KPI Engine provides a central solution to efficiently collect, calculate and store ESG-related data.

RELATED PRODUCT

Anti-Financial Crime

Real-time risk management and fraud prevention capabilities fully integrated in our Cloud for Banking platform.

Find out more about

Cloud for Mortgage

Contact us online and our team of experts

will get in touch with you shortly.